It’s pretty much guaranteed that at some point in your career, you’ll have to investigate employee theft, considering that 67% of employees have committed one or more types of theft in their current role. And while employee theft in the workplace is serious, it’s not a reason to panic — it’s proof of why skilled HR and ER professionals are essential. You’ll assess the situation, gather the facts, contain the damage and take appropriate action against the employee who stole.

Whether it’s merchandise walking out the door, falsified expense reports or other types of internal theft, prevention measures can only go so far. Even companies with strict bag checks like Amazon or Nordstrom can’t stop it entirely.

Bottom line: Employee theft will happen. Great HR and ER pros know how to handle it. Today, we’ll help equip you with the skills to manage employee theft when it occurs — and dive into the most common types to keep an eye out for.

Key Takeaways: Employee Theft

- Employee theft can take many forms, not just stealing items: It includes theft of merchandise, supplies, cash, payroll manipulation, time theft, data and intellectual property theft, fraud schemes like skimming or kickbacks, discount abuse and unauthorized use of services.

- Hidden and intangible thefts are serious: Things like falsifying hours, copying confidential information or misusing company access can be just as harmful as taking physical goods.

- Prevention relies on strong controls and culture: Effective time tracking, audits, surveillance, access restrictions, clear policies and training help detect and prevent employee theft.

What is Employee Theft?

Employee theft occurs when an employee steals from their employer — whether it’s money, merchandise, information or even time. A common misconception is that workplace theft always involves something physical or visible. The reality is different. Employee theft takes many forms, including intangible ones. From falsifying hours worked to leaking confidential data, these hidden forms of internal theft can be just as harmful as stealing items — sometimes even more.

The workplace has evolved tremendously over the past century — and so has crime. Back when paper currency ruled, employee theft was relatively straightforward. Workers waited until the office or store was empty, then raided the register or safe.

Today, with credit cards, direct deposits and digital banking, thieves have had to adapt. If they want to steal money, it’s all about going hacker-style to access online accounts. If they want to steal goods, they have to outsmart modern surveillance systems.

Employers have stepped up, too. Modern theft prevention in the workplace relies on encrypted digital locks, from point-of-sale (POS) systems to banking account passwords, layered with background surveillance tech. Most accounting software and online banking now monitor cash flow in real time — flagging suspicious logins, unauthorized transfers or sudden account changes before they spiral. But nevertheless, theft in the workplace still happens.

In American law, employee theft is a form of larceny. For employee theft to qualify as larceny, four elements must be present — unlawful taking, someone else’s possession, lack of consent and intent to permanently deprive the owner of what was taken.

Not all employee theft is the same. Now, we’ll walk you through the 14 most common types of internal theft.

The 14 Most Common Types of Employee Theft

There are 14 types of employee theft, each demanding its own prevention tactics. That said, some strategies overlap depending on the crime.

How you respond also changes with the kind of theft. Here are the 14 most common types of employee theft to watch for. We’ll also share some internal theft examples.

Merchandise Theft

Merchandise theft happens when an employee takes products straight from inventory or the sales floor. For example, a retail worker might pocket items without ringing them up, or a warehouse employee could stash goods to grab after their shift.

Stopping this usually means using surveillance, tightening inventory controls and training employees on company policies.

Supplies Theft

Supplies theft happens when team members take office or operational items — think paper, tools or equipment. For example, a team member using a company laptop for personal use or grabbing a bunch of Post-it notes to take home is committing supplies theft. Regular inventory audits and clear usage policies are key to cutting down on this type of theft. 27% of employees have stolen company supplies, including pens, paper, paper clips and folders.

Payroll Theft

Payroll theft is when employees game the system to manipulate their pay — like inflating hours or claiming pay for work they never did. For example, falsifying timesheets to pocket extra wages. The best defense? Reliable time-tracking and regular payroll audits.

Embezzlement

One of the most serious forms of employee theft, embezzlement happens when someone with access to company funds steals money for personal gain. For example, an accountant diverts payments into their own account. Tight internal controls and separating financial duties are essential to catch and stop this crime.

Skimming

Skimming is stealing money before it hits the books, so it’s essentially untraceable. For example, a cashier pockets money from a sale without ringing it up. Frequent cash counts and surprise audits are the best way to catch and stop skimming.

Cash Theft

Cash theft occurs when employees directly steal cash from registers, safes or petty cash funds. For example, a store clerk might take money from the cash drawer. Secure cash handling procedures and limited cash access cut this risk.

Fraudulent Disbursement

Making unauthorized payments by submitting fake invoices or expense reports is fraudulent disbursement. For example, an employee creating a fake vendor to siphon off funds (that end up going to them). Strong vendor checks and strict expense approvals are critical to stop it.

Data Theft

Stealing confidential company or customer info — like client lists or financial records — is data theft. For example, an employee copying sensitive files onto a personal device. Locking down access and tracking data transfers are essential to prevent it.

Time Theft

Time theft involves stealing pay by clocking hours you didn’t work — whether it’s long breaks or buddy-punching. The majority of American workers (54%) share that they’ve completed personal tasks while clocked in — such as cooking, laundry and cleaning. Tight time-tracking and strict oversight are non-negotiable to stop this form of employee theft.

Intellectual Property Theft

Intellectual property theft involves stealing proprietary ideas, designs or trade secrets. For instance, an employee might copy product designs to use at a competitor. Non-disclosure agreements and strict access controls help protect intellectual property.

Kickbacks

Secret payments or gifts given for special treatment of vendors or contractors are kickbacks. For example, a purchasing manager approving inflated invoices to earn personal kickbacks. Transparent procurement and strict conflict-of-interest rules are key to stopping this.

Bribery

Bribery occurs when offering or taking something of value to unfairly sway business decisions. For example, an employee accepting gifts to steer contracts to favored suppliers. Strong ethics training and whistleblower protections are vital to fight bribery.

Discount Abuse

Discount abuse is when employees misuse company discounts for unauthorized personal purchases or resell discounted goods. For example, a staff member might buy items at employee prices and sell them online. Monitoring discount usage and clear discount policies discourage abuse.

Theft of Services

Theft of services occurs when employees or others use company services for personal benefit without authorization. For example, an employee might use company vehicles for personal errands. Defining service usage policies and regular audits help prevent service theft.

Has Remote Work Impacted Employee Theft Rates?

Yes, remote work has impacted employee theft rates — and here’s why.

Every employer-employee relationship requires a degree of trust, especially if the team member is responsible for handling the organization’s finances. Given how common remote work has become, trust is more essential than ever before.

Remote work has driven a 20% jump in time theft, with employees citing home distractions as the main cause. That said, look back at our internal theft examples and you’ll see that remote setups may reduce certain types — like supplies and cash theft, since employees aren’t physically on-site to steal.

The distrust gets compounded by geographical distance associated with remote work. Managers worry that the lack of physical oversight makes it easier for employees to commit theft; a valid concern that makes monitoring software that much more important.

How to Future-Proof Your Business Against Employee Theft

While we can’t always control actions or fully understand motivations, certain factors raise the risk of employee theft. The good news: Strong HR and employee relations teams can help prevent it by ensuring fair pay, maintaining a healthy workplace culture and implementing effective anti-theft controls.

Because a company’s anti-theft policy is its first port of call in the event of suspected theft, it’s essential that it’s thorough, legally sound and up to date. Make sure all contract clauses and anti-theft policies comply with federal, state and local laws. Stay up to date on legal changes to keep your policies fully compliant.

Visibility is also important. Make your anti-theft policy clear and visible to the team. Train new hires on it during onboarding, and revisit it regularly to keep everyone aligned.

Suspect Employee Theft? Here’s What to Do Next

Think you’re facing employee theft in the workplace? First, know the warning signs: Bounced checks, missing inventory, unauthorized login alerts or unbalanced books. These red flags often point to theft. Once you suspect it, follow your established anti-theft policy to investigate — here are the key steps to take:

- Get legal counsel involved early to ensure due process and keep the case solid if you pursue criminal charges. It’s key to protecting your company from liability.

- Collect all relevant evidence and meet with the employee to discuss the suspected theft. Ideally, have an impartial third party present to ensure the process is fair and free from pressure. Include witnesses if they’re willing.

- Avoid using the word “theft” when talking to the suspected employee. Making unproven accusations can lead to defamation claims. Instead, say they’re “violating company policy.”

- Keep the case confidential. Any discussion about the case should take place only among the staff members and/or relevant stakeholders.

- HR or ER may decide to involve the police and press criminal charges. When that happens, ensure your evidence is airtight and ready for trial.

- If criminal charges are being filed, contact the organization’s insurers. Note, if you’ve not already consulted legal counsel, it’s time.

- Don’t deduct anything from the employee’s final paycheck if it’s decided to fire or suspend them.

- Assign an independent investigator to the case to help ensure impartiality and confidentiality. Have the third party conduct interviews and examine any evidence on your organization’s behalf.

- Document everything.

Can an Employee be Fired for Suspicion of Theft?

Yes, you can dismiss an employee suspected of theft — but only if you follow your workplace policies, contracts and any union agreements.

If immediate termination isn’t clear-cut, consider suspending the employee while you investigate. After reviewing the evidence, take action based on policy and the law. And if they’re cleared, make sure to apologize and compensate to avoid defamation claims.

What are Employee Theft Statistics?

Understanding the scope and impact of employee theft is important for businesses looking to protect their assets and improve workplace security. Here are some can’t-miss internal theft statistics:

- According to The Schulman Center, an estimated 60% of inventory losses occur because of employee theft.

- The industries most impacted by employee theft are banking, financial services and manufacturing, according to Association of Certified Fraud Examiners.

- According to the National Retail Federation, retail businesses lost $112.1 billion in inventory in 2022 alone, with employee theft accounting for 29% of those losses.

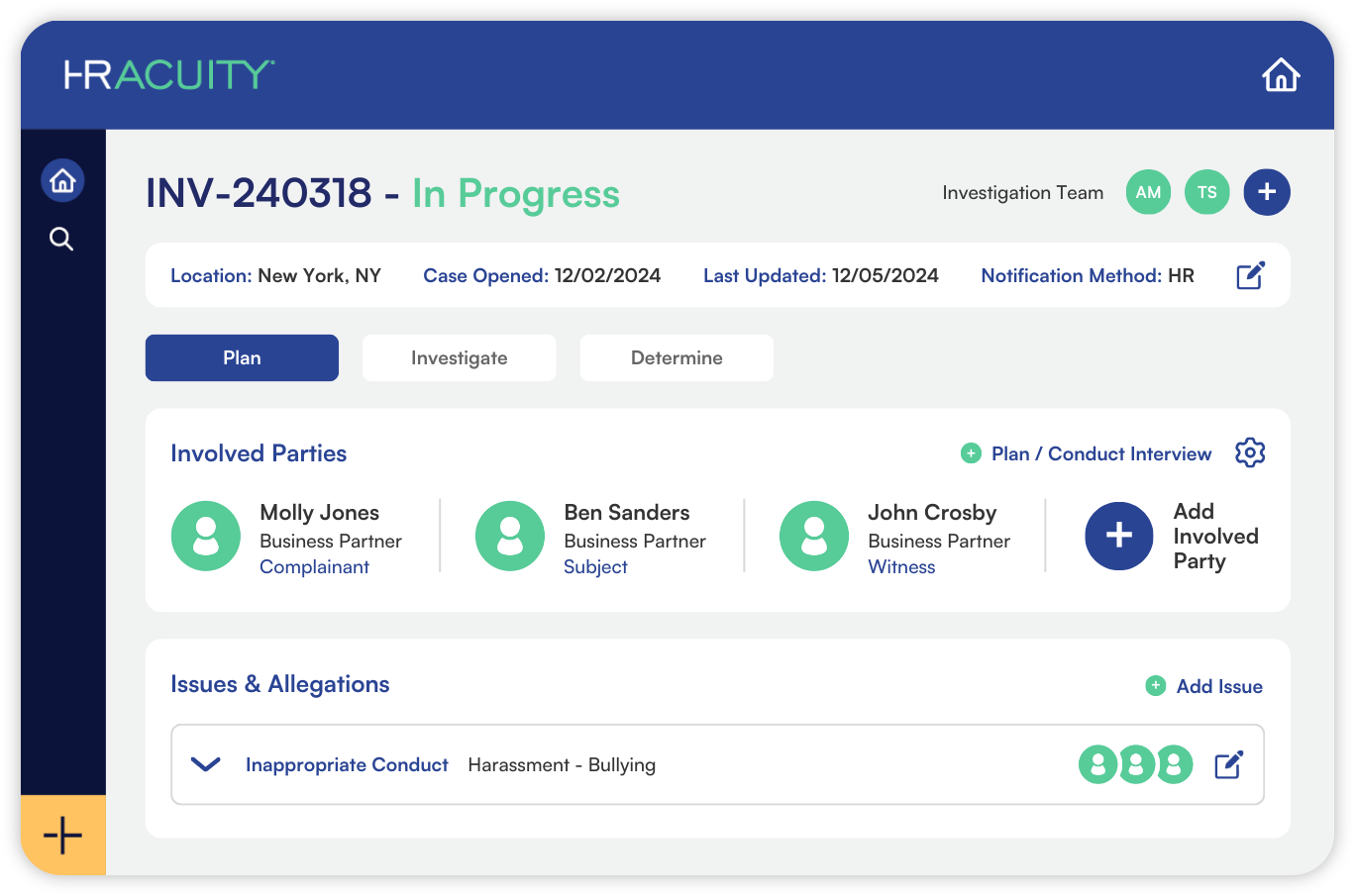

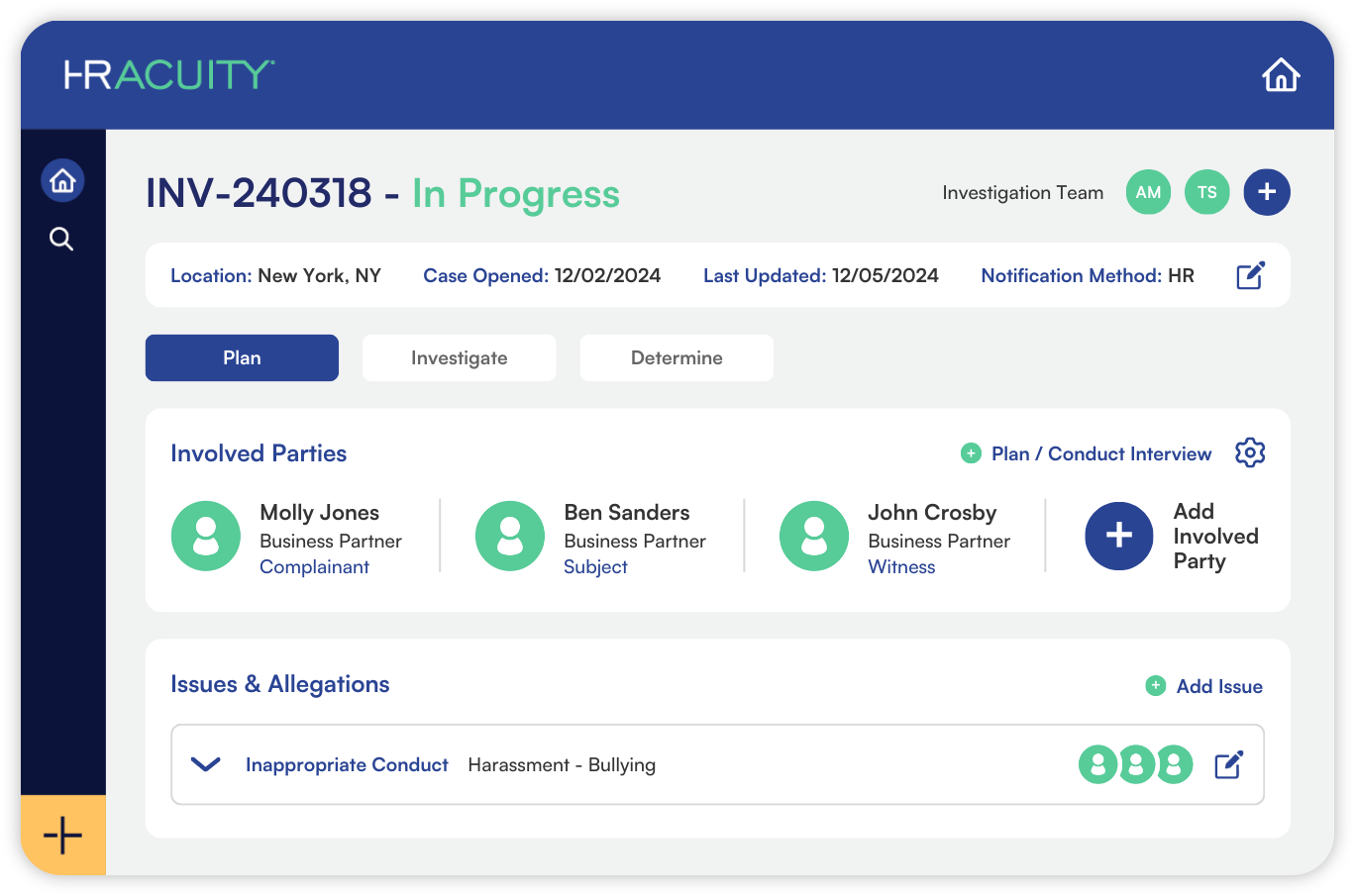

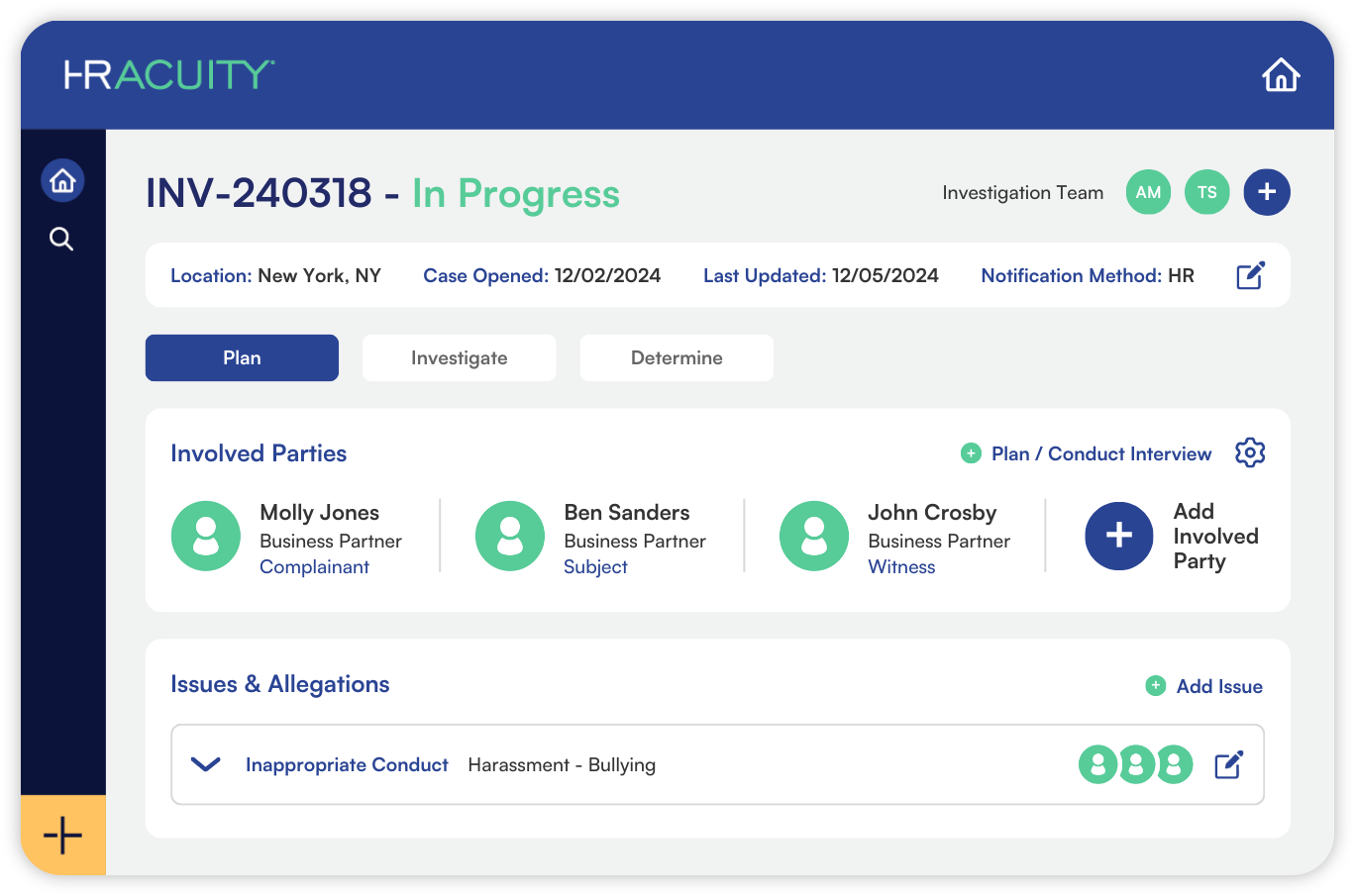

Handling Theft with Employee Relations Software from HR Acuity

No matter your organization’s size or type — small business, mega corporation or nonprofit — you need a strong anti-theft policy. Along with business insurance to cover potential losses, you must have programs in place to prevent and manage employee theft quickly and accurately.

To prevent theft in the workplace, consider risk management technology that boosts security and uses insights from past cases to sharpen your approach. Often, employees — not just ER teams or leadership — spot suspicious activity first. That’s why having a platform for anonymous employee reporting is crucial.

If employee theft in the workplace occurs, you’ll need tools to guide investigations, document every step, ensure legal compliance and keep data secure and confidential. Plus, it’s vital to enhance your overall data and network protection.

HR Acuity offers software that checks all these boxes and more. Here’s how we help businesses prevent and mitigate internal theft:

If you’re serious about staying ahead of workplace theft, HR Acuity is here to help. Reach out today to explore tailored solutions for your organization. Schedule a demo and see how we can help protect your business — together.